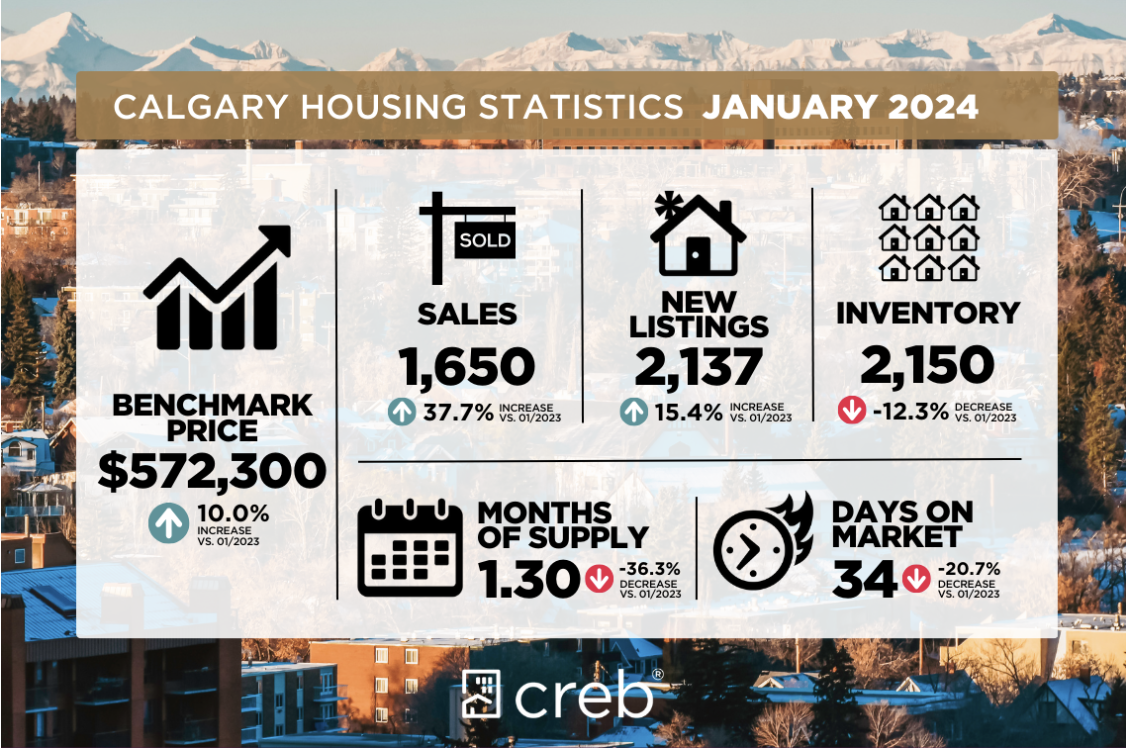

January sees strong sales fueled by boost in new listings

January sales rose to 1,650 units, a significant gain over last year's levels and long-term trends. The growth was possible thanks to a rise in new listings totalling 2,137 units in January. New listings rose for homes priced above $300,000, but the largest gains occurred for homes priced above $700,000. The rise in new listings relative to sales did little to change the low inventory situation in the city. With 2,150 units in inventory, levels are near the January record lows set in 2006 and are nearly 49 per cent below the long-term average for the month.

"Supply challenges have been a persistent problem since last year. This month's gain in new listings has helped provide options to potential purchasers, supporting sales growth. However, the growth in sales prevented any significant adjustments in supply, keeping conditions tight and supporting further price growth," stated Ann-Marie Lurie, Chief Economist at CREB®.

The months of supply in January was 1.3 months, falling over last month's and last year's levels. The persistent tightness in the market contributed to further upward pressure on home prices. The unadjusted benchmark price in January reached $572,300, a gain over last month and ten per cent higher than levels reported last January.

Detached

A boost in new listings helped support stronger sales this month. However, with a sales-to-new-listings ratio of 77 per cent, there was minimal change in the low inventory situation reported in the detached sector. New listings rose for all homes priced above $500,000, but the largest gains occurred in the over $700,000 market segment. Low inventory levels compared to sales prevented any improvement in the months of supply, which at 1.4 months was lower than levels reported last month and last January.

The exceptionally tight market conditions continued to drive further price growth. In January, the unadjusted detached price reached $702,200, nearly one per cent higher than last month and nearly 13 per cent higher than prices reported last year. Year-over-year price gains ranged from a low of 10 per cent in the City Centre and South East districts to a 27 per cent gain in the East district of the city.

Semi-Detached

With 223 new listings and 131 sales, the sales-to-new listings ratio fell to 59 per cent, the lowest level reported since 2020 and significantly improved over the 82 per cent average reported in 2023. The sudden shift did cause inventories to improve over the last month, but they remain well below long-term trends.

The unadjusted benchmark price in January was $625,000, slightly lower than last month but over 11 per cent higher than last January. The monthly decline was driven mainly by adjustments in the higher-priced districts of the West and City Centre.

Row

Like other property types, new listings and sales rose in January over levels reported last month and last year. However, with 322 new listings and 297 sales, the sales to new listings ratio remained exceptionally high at 92 per cent. This contributed to further reductions in inventory levels, and the months of supply once again fell below one month.

Limited supply and strong demand contributed to a rise in prices. In January, the unadjusted benchmark price reached $426,400, up over last month and nearly 20 per cent higher than levels reported in January 2023. While year-over-year prices are higher in every district, the West and City Centre districts saw unadjusted benchmark prices ease slightly over December.

Apartment/Condominium

Apartment-style properties continued to see the most significant gain in sales activity, rising to 488 sales in January, a year-over-year increase of 54 per cent. This was possible thanks to the growth in new listings. However, the gain in listings did little to supply levels; with 682 units, inventories were 40 per cent below long-term trends.

Tight market conditions continued to contribute to further price gains. In January, the unadjusted benchmark price reached $324,000, nearly one per cent higher than last month and 19 per cent higher than last January. Prices rose across all districts, with the largest year-over-year gains occurring in the most affordable districts of the North East and East.

REGIONAL MARKETS

COCHRANE

Eighty-three new listings and 70 sales occurred in January, keeping the sales to new listings relatively high at 84 per cent. This prevented any significant change in inventory levels compared to last month but caused the months of supply to fall below two months once again. The drop in the months of supply is a shift over the last four months, where the months of supply was over two months.

Despite recent tightening, the unadjusted benchmark price did ease slightly over last month’s levels. Overall, the unadjusted benchmark prices across all property types remained over 10 per cent higher than last January.

AIRDRIE

Stronger detached and row sales were enough to offset pullbacks in the semi-detached and apartment sectors, causing total residential sales to increase over levels reported last January. This, in part, was possible thanks to a boost in new listings. However, the boost in new listings and sales prevented any significant shift in inventory levels, which was half of the levels typically seen in the market.

While conditions remained tight, the unadjusted benchmark price remained stable over the last month but was nearly 10 per cent higher than levels reported in January 2023. The most substantial price gains have occurred for apartment-style homes, which are the most affordable property type.

OKOTOKS

Both sales and new listings rose in January compared to last month's and last year’s levels. This caused the sales to new listings ratio to fall to 75 per cent, which was still relatively high but an improvement over the 86 per cent average reported last year. Nonetheless, the sudden gain in new listings was insufficient to cause material changes to the low inventory levels.

With just over one month of supply, conditions remain tight in Okotoks, driving prices up. In January, the benchmark price reached $589,600, higher than last month's and year’s levels. Year-over-year price growth occurred across all property types, with gains ranging from a high of 15 per cent for row properties to a low of six per cent for apartment-style homes.

Comments:

Post Your Comment: